PayPal Alternative: 18 Alternatives You Should Know — Let’s Be Crazy.

Paying online and receiving money are now as natural as paying in cash after a restaurant visit. PayPal is a real factor in terms of online payment transactions and you can hardly get past the company from Silicon Valley. In this article, we want to show you some real alternatives to PayPal and explain why they make sense for freelancers and smaller businesses.

Why can a PayPal alternative be useful? (Advantages and disadvantages of PayPal)

First of all, we need to clarify whether an alternative to PayPal makes sense at all. To answer this question, we should first look at the pros and cons of PayPal.

One of the advantages is that paying with PayPal is relatively easy and you can carry out your transaction very quickly. The company is sensitive to buyers’ payment details and you can send money to friends, relatives or any people. PayPal offers buyer protection, they reimburse the cost of returns and the management of the PayPal account is free of charge. In addition, PayPal is now very common and you can pay with PayPal almost anywhere in the digital world.

One of the disadvantages of PayPal is that the company stores all data on servers in the USA. In terms of data protection, this is more of a grey area. Furthermore, PayPal data to third parties and merchants are charged fees so that they can participate in the payment network.

The 8 Best PayPal Alternatives for Private Online Payments

Now that we have shown you the advantages and disadvantages of paying with PayPal, here are the 8 best PayPal alternatives for private online payments.

Immediately from Klarna. Klarna Sofortüberweisung is a service of the Swedish Klarna Bank.

Klarna Sofortüberweisung is a service of the Swedish Klarna Bank. If you have an account with a German bank, you can also use the services of Klarna Sofort without any problems. When buying online, you enter your known access data of online banking and process the purchase. Nobody gets to see your data during the transaction. Worldwide, you can already buy from more than 200,000 retailers via Klarna.

Instant fees for payers: there are no fees for customers

Instant fees for payees: 1.35% of the invoice amount + €0.20 per transaction – no entry fee or monthly fee

Does Sofort offer buyer protection? Yes

Advantages of Sofort over PayPal:

- Complete purchase with 1 click

- no registration required

- Benefit from buyer protection

- Klarna assumes credit and fraud risk

Disadvantages of Sofort compared to PayPal:

- no way to send money

- no individualized cost model

- no assumption of return costs

- Payment transactions can be traced by the provider (data protection concerns)

Paydirekt was launched as a joint project by some German banks and savings banks.

Paydirekt was launched as a joint project by some German banks and savings banks. You have to have an account with one of the participating banks and paydirekt is then an additional function with which you can make payments online. The German data protection regulations are strictly adhered to, but paydirekt is not widespread. Currently, you can pay with paydirekt in around 10,000 online shops.

Paydirekt fees for payers: there are no fees for customers

Paydirekt fees for payees: 1.90% of the invoice amount and €0.35 per transaction

Does paydirekt offer buyer protection? Yes

Advantages of paydirekt over PayPal:

- benefit from the exclusive discounts

- no third-party providers are required for payment

- Benefit from buyer protection

- Bank keeps sensitive data with it

- paydirekt adheres to German data protection regulations

Disadvantages of Paydirekt compared to PayPal:

- currently not too widespread

- so far, phishing attacks are still increasing

- only possible at participating banks

GooglePay

With GooglePay, the global corporation has launched its own payment service. Since June 2018, customers in Germany have also been able to access this payment service. GooglePay can be used to process in-app payments, transactions in brick-and-mortar stores and payments in online shops. There are also high security standards here and the use of GooglePay is free of charge. However, GooglePay is not yet very widely used, but the number of phones with Android operating systems is immense. So there is a lot of potential in it.

GooglePay fees for payers: there are no fees for customers

GooglePay fees for payees: there are no additional costs for merchants

Does GooglePay offer buyer protection? No

Advantages of Google Pay over PayPal:

- high safety standard

- Pay quickly and easily online or at the POS

- sensitive data will not be passed on

- multiple loyalty cards can be stored in the application

Disadvantages of Google Pay compared to PayPal:

- not supported by all smartphone providers

- is not offered by all banks

- NFC payment not possible everywhere

- no buyer protection

- no assumption of return costs

Amazon Pay

Of course, Jeff Bezos’ Internet giant also has its own online payment service, but it is not nearly as widespread as the parent company. Nevertheless, Amazon Pay naturally benefits from Amazon’s notoriety and reputation. So you need an active account with Amazon, in which the payment information is already stored. To purchase, you only enter your username and password and Amazon processes the payment here as an intermediary. The fees are comparable to those of PayPal. Sensitive data does not have to be entered by the customer.

Amazon Pay fees for payers: there are no fees for customers

Amazon Pay fees for payees: 1.90% of the invoice amount and €0.35 per transaction

Does Amazon Pay offer buyer protection? Yes

Advantages of Amazon Pay over PayPal:

- no transmission of payment data to third parties

- no additional account with the trader required

- high safety standard

Disadvantages of Amazon Pay compared to PayPal:

- can only be used on Amazon

- Consumer protection concerns

Giropay

The online payment service giropay, similar to paydirekt, is also a joint project of various German credit institutions. These include, but are not limited to: The Postbank, Sparkassen, as well as all Volks- and Raiffeisenbanken. You need an account with one of the participating banks and when paying online you will be redirected to the respective account. Also giropay is not yet so widespread and there is also no buyer protection.

Giropay fees for payers: there are no fees for customers

Giropay fees for payees: 99 € setup fees, 9.90 € monthly fees (100 transactions included), from 101st transaction – 0.09 € transaction costs, at least 0.33 € and max. 0.95 % of turnover, 0.49 € per age verification, 0.19 € per payment confirmation

Does Giropay offer buyer protection? No

Advantages of Giropay over PayPal:

- no additional registration required

- Transfer is much faster than online transfer

- high safety standard

- no privacy concerns

Disadvantages of Giropay compared to PayPal:

- no buyer protection

- no assumption of return costs

- so far, phishing attacks are still increasing

- is not supported by all banks

Apple Pay

Apple offers a mixture of online payment service and contactless payment in the store with Apple Pay. With the help of newer Apple devices, payment is unfortunately only possible for a limited group of people. High security standards apply and no sensitive data is stored on the device. When it comes to Apple products and services, it’s always worth taking a closer look. However, we should only dare to take this look in some time, because currently this payment service is not yet a real alternative.

Apple Pay fees for payers: there are no fees for customers

Apple Pay fees for payees: there are no fees for merchants

Does Apple Pay offer Buyer Protection? Yes

Advantages of Apple Pay over PayPal:

- no account required

- high safety standard

- Pay quickly and easily online or at the POS

- Payment data is not stored on the device

- multiple loyalty cards can be stored in the application

- Fees are borne by the financial institutions

Disadvantages of Apple Pay compared to PayPal:

- only possible for Apple users

- is not offered by all banks

- NFC payment not possible everywhere

viacash

With viacash, the online purchase is a little different. You pay normally in your online shop and get a payment slip. You then have to pay for this in cash in one of the affiliated dealer branches. You take this payment slip printed out or on your smartphone. Currently, around 8,000 online shops already use the viacash service.

viacash fees for payers: there are no fees for customers

viacash fees for payees: 1.90% of the invoice amount + € 0.35 per transaction, monthly license fee of € 19.90

Does viacash offer buyer protection? Yes

Advantages of viacash over PayPal:

- no account required

- no transmission of payment data to third parties

- no concerns about data protection

Disadvantages of viacash compared to PayPal:

- Payment is made to a contractual partner in a local shop

- is only offered to certain contractual partners

Masterpass

Masterpass is the online payment solution of the credit card company Mastercard. Initially, it was only intended for your own customers, but Masterpass is now accessible to all credit card holders. The customer’s credit card is deposited with Masterpass as a means of payment and the purchases are charged via it. In turn, there are no fees for the customer. Masterpass is available as an app or you can also pay with it normally at the online shops. In Germany, however, this solution has already been discontinued. However, it is still available in other countries such as Austria.

Masterpass fees for payers: there are no fees for customers

Masterpass fees for payees: there are no fees for merchants

Does Masterpass offer buyer protection? Yes

Advantages of Masterpass over PayPal:

- high safety standard

- no fees

- multiple loyalty cards can be stored in the application

- Customers benefit from the bonus program

- Credit card details do not have to be entered in the online shop

Disadvantages of Masterpass compared to PayPal:

- Billing only possible via credit card

- no longer available in Germany

A similar service to Remitly is also offered by WorldRemit

A similar service to Remitly is also offered by WorldRemit. Founded in 2010 and thus still quite young, the company works with a very favorable fee structure. The recipients can have the money transferred to their account, but can also pick it up at a payout point or have it delivered to their home.

WorldRemit is a cross-border digital payments service that provides international money transfer and remittance services in more than 130 countries and over 70 currencies. It was founded in 2010 by Ismail Ahmed, Catherine Wines, and Richard Igoe.

WorldRemit fees for payers: Amount of the fee depends on the amount of money and destination country, transaction fee between 0.95 € and 21.99 €, the first transfer is free of charge, cash advance fee when paying by credit card

WorldRemit fees for payees: fees of the banking institution may apply, small fee due to currency conversion

Does WorldRemit offer buyer protection? No

Advantages of WorldRemit over PayPal:

- Large network of cash pickup locations

- Wide range of transfer options

- fast and convenient money transfer

- high safety standard

Disadvantages of WorldRemit compared to PayPal:

- limited number of sender countries

- especially with higher amounts often expensive compared to other providers

- country-specific transfer limits

- complicated registration process (some documents are required)

Payoneer is an online payment service provider that allows you to make payments and receive money

Payoneer is an online payment service provider that allows you to make payments and receive money. This works worldwide and across the borders of currencies. Payoneer is for business transactions only. Not only are payments made by companies, but Payoneer also works with various marketplaces, such as Amazon, Fiverr or Upwork. Payoneer already has more than 4 million users and is available in 200 countries.

Payoneer fees for payers:

Transaction costs: 1.00% (ACH Bank Debit), 3.00% (credit card), 1.00% (local bank transfer), up to 2.00% + €1.50 (if the recipient does not have a Payoneer account), foreign currency fee 0.50% of the transaction amount, account fee of €29.95 (only if no transactions have taken place in the last 12 months)

Payoneer fees for payees: Transaction costs: 0 – 1.00% for wire transfer in USD, 3.00% (credit cards), 1.00% (ACH Bank Debit), account fee of €29.95 (only if no transactions have taken place in the last 12 months), currency conversion fee

Does Payoneer offer buyer protection? No

Advantages of Payoneer over PayPal:

- greater supply of currencies than PayPal

- wide variety of payment services

Disadvantages of Payoneer compared to PayPal:

- many different fees

- Currency exchange can be difficult

- Strict terms and conditions

The Skrill payment system is a classic prepaid solution.

The Skrill payment system is a classic prepaid solution. You deposit a sum of money into your Skrill customer account in advance from your current account or credit card. You then have this available there to shop on the Internet. You cannot overdraw your Skrill account and thus protect yourself from excessive expenses. Since the company is based in England, the assets are unfortunately not protected in the event of insolvency. However, you decide for yourself how much money you want to deposit into your customer account.

Skrill fees for payers: 1.00 % transaction costs, € 25.00 (credit and debit cards) € 7.00 (direct debit) chargeback costs, € 1.00 per month if the account has not been used for more than 12 months

Skrill fees for payees: 2.90% + €0.25 transaction costs, €0.49 per transaction chargeback costs, €1.00 per month if the account has not been used for more than 12 months, currency exchange rate conversion fee

Does Skrill offer buyer protection? No

Advantages of Skrill over PayPal:

- Bank details are not transmitted to merchants

- Cost control due to prepaid system

Disadvantages of Skrill compared to PayPal:

- not yet widely used

- Cancellations not possible

- additional services for a fee

- so far, phishing attacks are still increasing

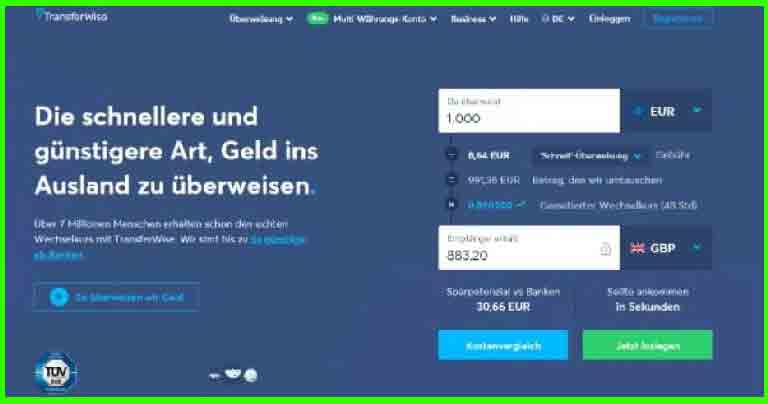

Transfer Wise could perhaps become a small revolution in foreign transfers.

Transfer Wise could perhaps become a small revolution in foreign transfers. If you want to transfer money abroad with Transfer Wise, for example to the USA, then you transfer the amount to Transfer-Wise first. They are then looking for another customer in the USA who wants to transfer a similar amount abroad. The recipient of your money in the USA then receives the money from the customer in the USA who wants to transfer a similar amount to you. As a result, money is never really sent and no currencies have to be converted. Simple and ingenious. Currently, «TransferWise» only works in a few countries, but that can change quickly.

«Wise» fees for payers: when transferring €2,000, there is a 0.045% transaction fee, currency exchange fee: 0.33%–3.56%,

Transfer Wise fees for payees: fees of the banking institution may apply, small fee due to exchange rate conversion

Does Wise Transfer offer buyer protection? No

Advantages of Transfer Wise over PayPal:

- 90% of all transactions are transmitted within one working day

- Up to 14x cheaper than PayPal

- Clear price structure

Disadvantages of TransferWise compared to PayPal:

- Limited number of currencies available

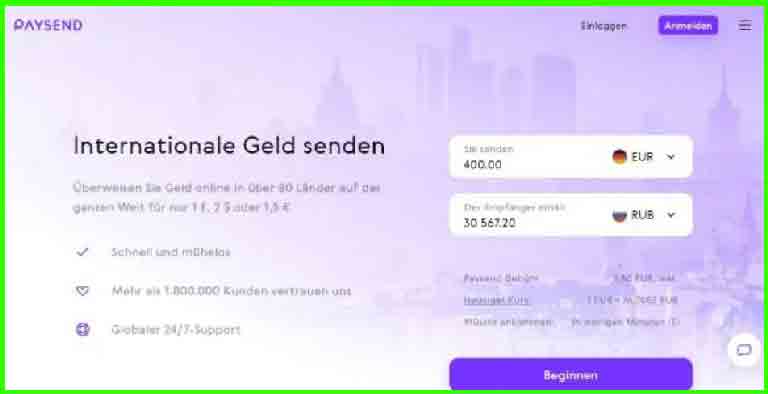

Payments can be made to more than 100 countries via PaySend.

Payments can be made to more than 100 countries via PaySend. You set up a PaySend user account and can then use it to make payments. All money transfers are certified according to international standards, so secure. Before each transfer, PaySend transparently displays the fees and the conversion rate. The money is processed in seconds and arrived at the recipient.

PaySend fees for payers: 1,50 € transaction fee up to 150,00 €, from 150,01 € plus 1,00 % transaction fee

PaySend fees for payees: fees of the banking institution may apply, fee by currency conversion

Does PaySend offer buyer protection? No

Advantages of PaySend over PayPal:

- high safety standard

- greater supply of currencies than PayPal

- wide variety of payment services

- Simple fee model

Disadvantages of PaySend compared to PayPal:

- complicated registration process (some documents are required)

- lack of transparency in the source of the exchange rate

Stripe is an online payment service that offers its customers a lot of additional services and software tools.

Stripe is an online payment service that offers its customers a lot of additional services and software tools. Stripe can be used to bill simple purchases on the Internet, but also subscription models. In order to collect the money from the customer, the customer must then enter either his bank details, credit card information or PayPal account.

Stripe fees for payers: there are no fees for customers

Stripe fees for payees: 1.40% + €0.25 transaction fees (for European cards), 2.90% + €0.25 transaction fees (for non-European cards)

Does Stripe offer buyer protection? No

Advantages of Stripe over PayPal:

- Real-time fee reporting and transparent fee setting

- widely used PayPal alternative

- wide variety of payment services

- high safety standard

Disadvantages of Stripe compared to PayPal:

- Access to the money is only possible a few days after the transaction

- Merchant accounts are only available in a few countries

For sending money via MoneyGram, you have over 350,000 locations worldwide

For sending money via MoneyGram, you have over 350,000 locations worldwide, which are spread over 200 countries. You can make your payments through MoneyGram’s website or in one of the branches and send them to either a bank account or a mobile phone number. The payment transactions are quite secure, as the recipient must identify himself when picking up the money and show a reference number. Within just 10 minutes, the money is with the recipient. However, the fees at MoneyGram are relatively high and scare off at first.

MoneyGram fees for payers: €1.99 transfer fee, €3.99 transaction fee, surcharge on exchange rate

MoneyGram fees for payees: fees of the banking institution may apply, fee by currency conversion

Does MoneyGram offer buyer protection? No

Advantages of MoneyGram over PayPal:

- widely used PayPal alternative

- high safety standard

- Money transfers can be made in cash, bank accounts and mobile wallets

- Large network of cash pickup locations

- fast money transfer

Disadvantages of MoneyGram compared to PayPal:

- Surcharge on exchange rate

- significantly more expensive than specialized online providers

At CurrencyFair you can transfer your money abroad

At CurrencyFair you can transfer your money abroad and usually get a better exchange rate than at your local bank. This works according to the peer-to-peer principle. You transfer the money to CurrencyFair and they are looking for a counterpart who wants to transfer a similar sum in your direction. If both then agree with the exchange rate, then the transfer transaction is carried out. By the way, your money is completely secured by the Bank of Ireland.

CurrencyFair fees for payers: €3.00 transaction fee, possibly commission fee for currency exchanges of 0.1%–0.6%, small surcharge on exchange rate

CurrencyFair fees for payees: fees of the banking institution may apply, small fee due to currency conversion

Does CurrencyFair offer buyer protection? No

Advantages of CurrencyFair over PayPal:

- Fixed fee (even high amounts at low cost)

- very small exchange rate mark-ups

- high safety standard

- quick and easy money transfer

Disadvantages of CurrencyFair compared to PayPal:

- Limited number of supported currencies

- for bank transfer can only be paid by bank change

- complicated registration process (some documents are required)

The payment service provider Xoom was bought by PayPal some time ago

The payment service provider Xoom was bought by PayPal some time ago. With Xoom, it is now possible for PayPal customers to transfer money to friends and relatives abroad. With the help of your PayPal account, you can easily open your Xoom account and take over the stored payment information. Unfortunately, it is not possible to use your PayPal credit.

Xoom fees for payers: Transaction fee between € 1.00 and € 3.00

Xoom fees for payees: fees of the banking institution may apply, 4.99 € fee for cash collection, fee by currency conversion

Does Xoom offer buyer protection? Yes/No

Advantages of Xoom over PayPal:

- Large network of cash pickup locations

- Wide range of transfer options

- high safety standard

- especially widespread in Latin America

- fast money transfer

- Service from PayPal

Disadvantages of Xoom compared to PayPal:

- non-transparent exchange rate surcharge

- significantly more expensive than other specialized online providers

- complicated registration process (some documents are required)

In order to make a payment abroad with Western Union

In order to make a payment abroad with Western Union, both partners need a customer account with Western Union.

The deposit to this account is then made by bank transfer or credit card payment.

The money transfer is then in principle, like an ordinary transfer. The recipient can then have the money paid out in a branch near him.

Western Union now has more than 500,000 locations worldwide.

Western Union fees for payers: €1.90–€4.90 transfer fee, €7.00 transfer fee for cash deposit

Western Union Fees for Payees: Pick-up fee for cash transfer between € 9.90 and € 36.00, hidden fees due to currency conversion

Does Western Union offer buyer protection? No

Advantages of Western Union over PayPal:

- Large network of cash pickup locations

- Wide range of transfer options

- Wide range of currencies

- high safety standard

- Easy and fast money transfer

Disadvantages of Western Union compared to PayPal:

- Often problems with the refund in case of unsuccessful money transfer

- Surcharge on exchange rates

- not all transfer offers are valid in all countries

- Transfers to certain countries entail high fees

Remitly is an online payment provider that works completely online

Remitly is an online payment provider that works completely online and therefore has very favorable conditions.

All you have to do is set up a customer account with Remitly and then you can make your payments to many countries.

You can transfer the money directly to a foreign account, or the recipient can also have the money delivered.

However, you will need the exact data on the recipient’s identity card.

Remitly fees for payers: Transaction fee between € 0.00 and € 4.99

Remitly fees for payees: fees of the banking institution may apply, small fee due to exchange rate conversion

Does Remitly offer buyer protection? No

Advantages of Remitly over PayPal:

- Large network of cash pickup locations

- Fixation of exchange rates possible

- 100% satisfaction guarantee (otherwise refund of fees)

- fast, easy and cheap money transfer

- high safety standard

Disadvantages of Remitly compared to PayPal:

- limited number of countries possible

- Fees are important for small transfer amounts

Conclusion: Large selection of great alternatives to PayPal

We hope that in this article we were able to show you a few alternatives to PayPal.

Each payment provider has its advantages and disadvantages, its strengths and weaknesses.

We wanted to offer you an overview here, so that you can make the right decision for yourself.

Every entrepreneur has different demands and needs.

Was the right provider there for you?